How to Analyze Your MT5 Trading History for Better Decision-Making

3/24/2025, 10:25:10 AM

Analyze your MT5 trading history to refine strategies, improve risk management, and enhance decision-making. Join FundingPips for a seamless trading experience!

How to Analyze Your MT5 Trading History for Better Decision-Making

MetaTrader 5 (MT5) is a popular trading platform that offers powerful tools to analyze markets, execute trades and view trading history. While traders focus on opening and closing positions, it is essential to examine your past performance to stay successful in the long run. A thorough review of trading history can let you explore your weaknesses and strengths and refine your trading strategies. The article will guide you in reading your trading history to enhance decision-making and performance optimization.

If you analyze your past trades, you can refine your risk management, improve your entry and exit points and establish a better discipline in trading. Understanding what works for you and what doesn’t can make a difference and boost your confidence in trading.

Join FundingPips to start using MetaTrader 5 for your trading with a seamless experience and many other benefits.

How to Access Your MT5 Trading History

Follow these steps to access your MT5 trading history:

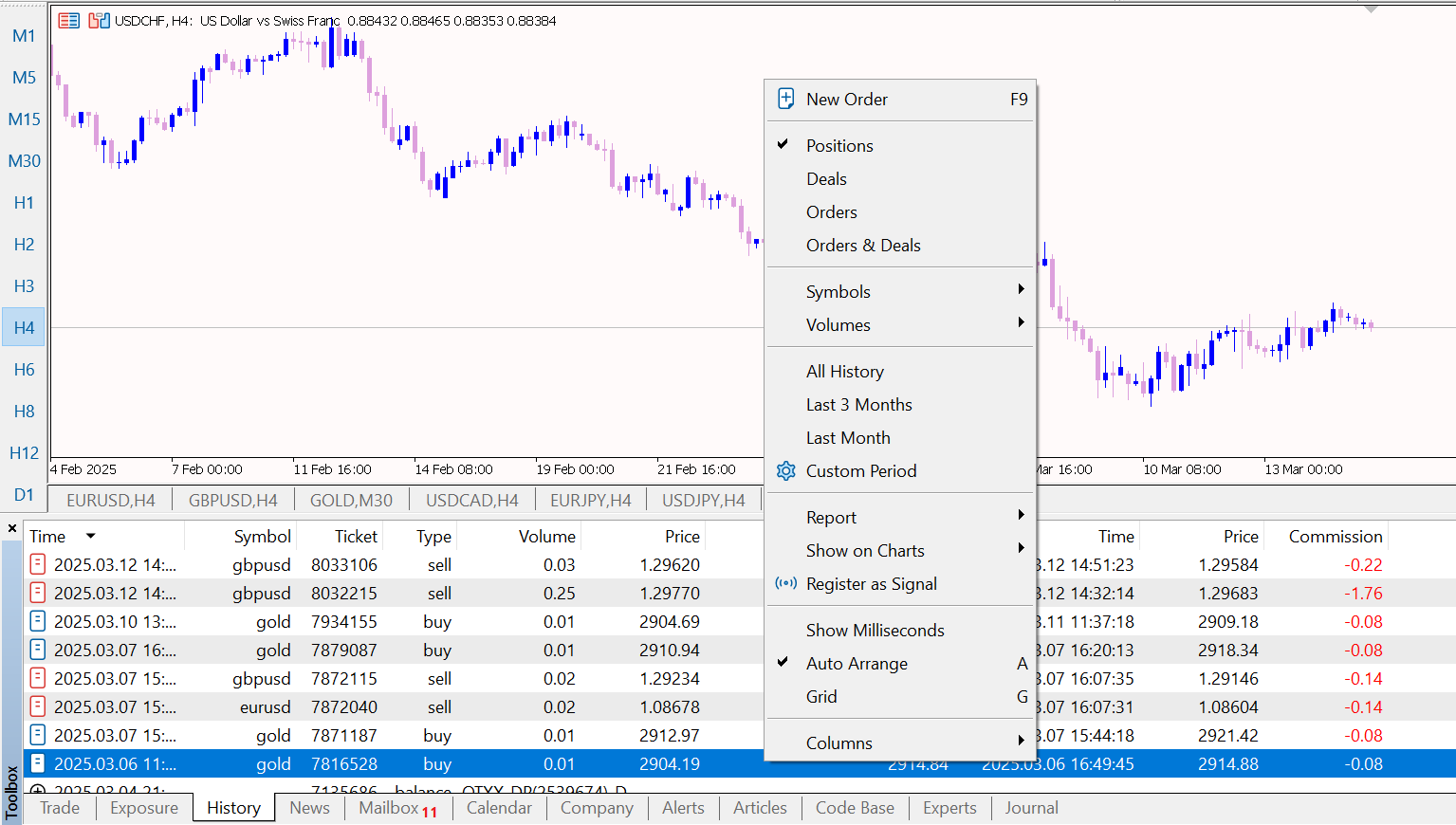

Open the History Tab at the bottom in the terminal window.

Right-click on the history window and select the timeframe like last week, last month or all history.

You can filter trade types to focus on specific strategies.

You can export your history for further analysis by clicking Save as Detailed Report.

You can conduct a comprehensive analysis of your trading history and find past trades on the charts. You can switch to different chart types in MT5 to better visualize price movements effectively.

Key Metrics to Analyze in MT5

Once you get access to your trading history, focus on understanding the following metrics:

Identify profit and loss periods and try to understand the market conditions that impacted your performance.

Compare the average winning trade with the average losing trade to find if your reward outweighs the risk.

Find out the win rate and max drawdown to know how much of your balance declined after consecutive losses.

You can find out your past trades on the charts. Visualizing the trades can help you undedrstand if you had grasped those positions rightly or not.

Identifying Strengths and Weaknesses in Your Trading Strategy

You trading strategy could be flawed. You can tweak your strategy to make it effective. Here’s how you can use your trade history in your advantage:

Common Mistakes to Avoid: Ignoring stop-loss, overleveraging or holding trades too long can lead to unnecessary losses.

Spotting Winning Patterns: Find out which trading logics work for you that consistently yield profits.

Correctly identifying your weaknesses can give you an edge to improve your performance and let you trade optimally. Hence, historical data ensures your approach is fine-tuned and not based on emotions or guesswork.

Using Advanced MT5 Analysis Tools

MT5 offers many built-in and third-party tools for more profound insights:

Built-in Reports: The Detailed Report option gives you an insight into your drawdown, profit factor, risk level, trade duration, monthly profit/loss, etc. You can press Alt + E to view the detailed report.

Third-Party Analysis Tools: Tools like MyFXBook and FXBlue allow you a more detailed statistical view of your trading history. You can connect your MT5 account with these tools for free.

Trading Indicators in MT5: Utilize technical indicators like MACD, Fibonacci, RSI, SMA, etc, for a further data-driven approach.

Market Analysis with MT5: Combine the technical tools of MT5 to enhance your market analysis.

You can use MT5 reporting features and connect your account with external resources for an in-depth view of your trading history.

Other than MT5 analytics, FundingPips offers an extensive dashboard for its traders to analyze different performance metrics in detail.

Creating a Trading Journal for Continuous Improvement

A trading journal is essential to track your decisions and emotional influences. Let’s see how you can maintain your journal effectively:

Document Every Trade: Record every trade with entry and exit price, date and time and reasons for trade.

Review Weekly and Monthly Trends: Evaluate your performance every week and every month to identify your mistakes or winning patterns.

Consider Psychological Factors: Reflect on how emotions like impulsiveness, greed or fear influenced your trading decisions.

Conclusion

Analyzing your trade history in MetaTrader 5 (MT5) is an integral part of your long-term trading success. The trading platform comes with several built-in features that help you study your trading history in great detail. You can identify your strengths and weaknesses and tweak your trading strategies to optimize your trading performance. Creating a trade journal can help you control emotions and implement your trading strategy effectively.

FundingPips offers MT5 as a trading platform for its traders. Join now to avail yourself of excellent features and growth without risking your capital.