Futures Market vs. Forex Market: Which One Suits Prop Firm Traders Best?

8/25/2025, 10:10:47 AM

Discover how futures and forex markets operate, their potential benefits, and a comparison to find your best pick.

Financial markets trading is on the rise, with the futures and forex markets being the most heavily traded. Prop firms are strongly in demand, and traders are turning to them for resources in exchange for a profit split.

The forex market runs 5 days a week, 24 hours a day. It deals with currency pairs.

The futures market is accessible around the week but with short active windows. It deals with standardized contracts like currencies, commodities, indices, etc.

Funded traders need to choose the right market, as it directly impacts the trading style, risk exposure, and potential profits. Each prop firm has distinct rules for both markets, depending on volatility, trading hours, and liquidity. You can trade the forex market on FundingPips with a generous profit split and smooth execution.

Ready to earn profit from the forex markets? Join FundingPips today, where you can access a wide range of financial instruments and a global community for support and growth in your trading journey.

Understanding the Basics

The forex market is known for its high liquidity and 24-hour accessibility, covering all global trading sessions. It allows traders to trade several currency pairs at any time. It is a decentralized and over-the-counter market where you can trade major pairs like EUR/USD, USD/JPY, etc, or crosses and exotics like GBP/JPY, EUR/ZAR, and many others.

On the other hand, the futures market involves standardized contracts in a centralized exchange that require traders to buy or sell an asset at a future date with a set price. It offers transparency and consistency. It is a high-leverage and high-margin market where you can trade stocks, indices, and commodities.

What Are the Key Similarities & Differences?

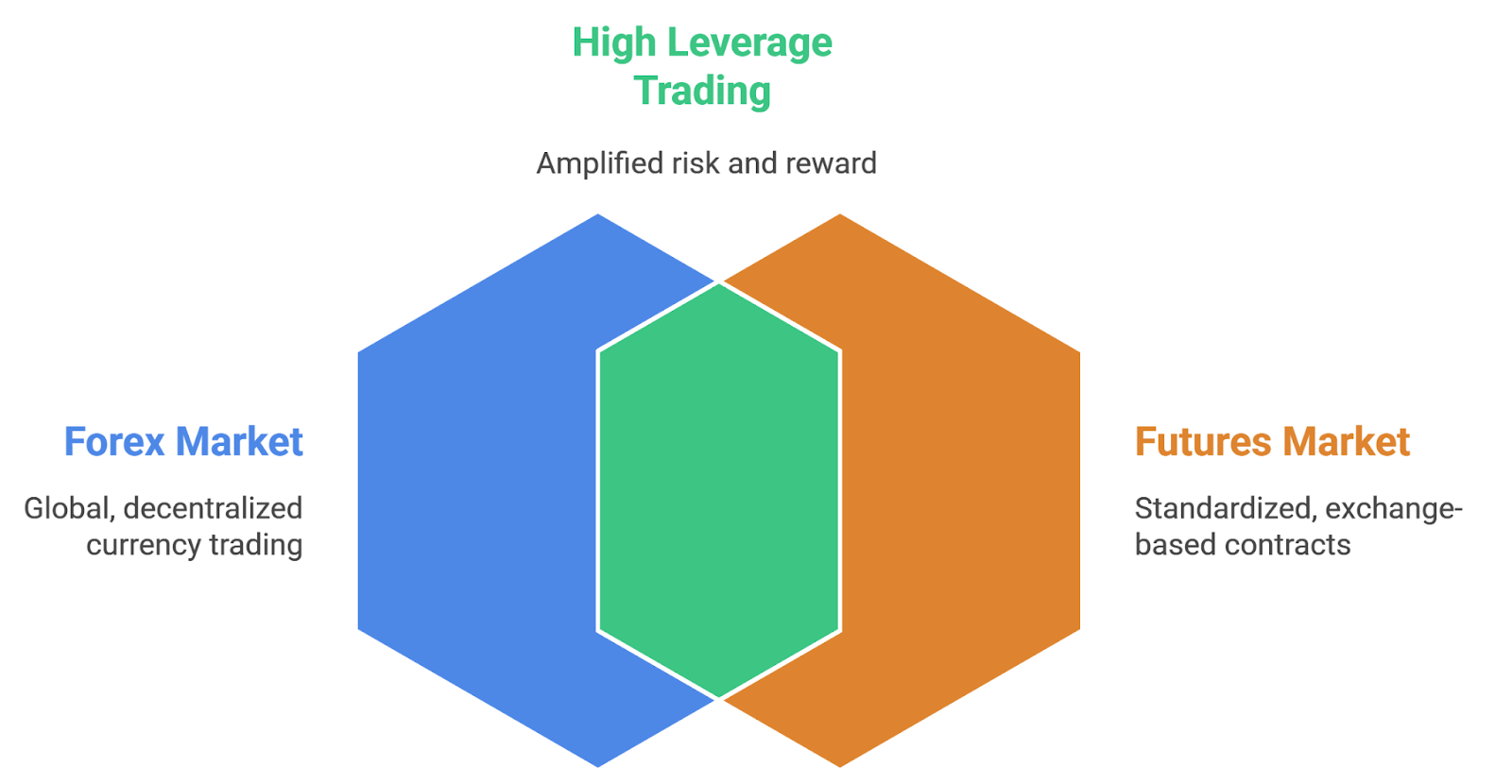

Despite serving different purposes, futures and forex markets share some similarities. For instance, both markets offer high leverage and liquidity, but with various limits. Both are accessible during the week, with forex available round the clock. Both cover all global trading sessions.

However, the markets are quite different in some ways. Forex offers a high margin compared to futures. Forex is limited to currency pairs, while futures provide a diverse range of assets. The futures contracts settle on a future date, while forex trades are settled instantly. The ultimate choice depends on factors like your time commitment, risk appetite, and trading strategy.

How Prop Firms Work in Forex vs. Futures

Each firm has different structures, trading processes, and growth plans for the forex and futures markets. Let's dive into the factors.

Typical Prop Firm Structures

The prop firm structures are unique for each market. For forex trading, the firms provide traders with resources to trade after clearing instant funding or evaluation-based models.

In the future markets, firms provide traders with access to structured contracts. Traders must follow the risk control rules and meet the margin requirements. A common factor in both is their profit-split arrangement.

FundingPips lets traders trade the forex market with clear risk-management rules, drawdown limits, and position sizing. It offers a great profit split ratio with scaling up to $2 million.

Evaluation Processes and Trading Challenges

All prop firms ensure that traders are skilled and capable enough to navigate the challenges and the psychological strain of trading. Traders have to pass some evaluation phases to meet profit targets and prove discipline and consistency before getting access to the firm's resources.

Capital, Payouts, and Scaling Options

The prop firms ensure that traders can trade without any financial burden. The payouts are quick, and traders keep some percentage of the profit. Various prop firms have scaling options that allow traders to grow their account size as they steadily meet targets. Remember, to grow, you must stay resilient and persistent.

Join Fundingpips to enjoy quick payouts and extraordinary scaling plans.

Key Comparison Factors of Forex and Futures

The following table reveals a quick comparison of both markets:

Type | Forex Market | Futures Market |

Leverage | The high leverage comes due to centralized trades. | The high leverage comes from margin requirements. |

Liquidity | Significantly liquid in major pairs like EUR/JPY and EUR/USD, etc. | Extremely liquid in contracts like gold, oil, and E-mini S&P 500. |

Volatility | Moderate volatility that mainly changes during new events and geopolitical changes. | Volatility changes with the contract type. For instance, oil and gas are highly volatile. |

Costs | Requires commissions, swaps, and data fees for holding overnight positions. | Includes commissions and data fees but no swaps. For overnight positions, the margin must be ample. |

Hours | Operates Monday to Friday, 24 hours every day. | Operates all week but with shorter active hours. |

Risk Management and Regulations

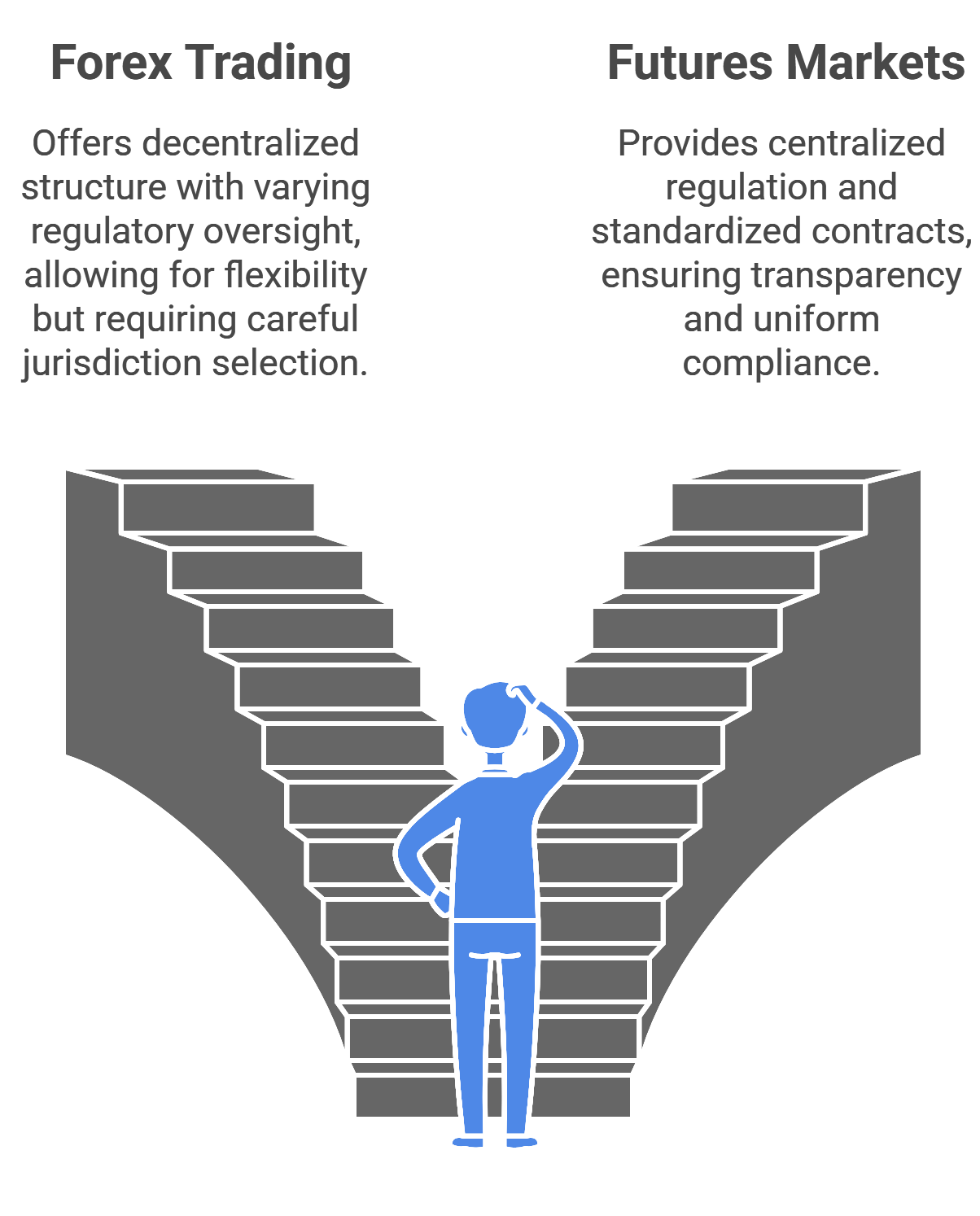

The regulatory environments of the forex and futures markets differ significantly, shaping how prop firms design their risk management frameworks.

What Are the Available Platforms & Tools For Both Markets?

Forex and futures market traders have access to advanced professional tools and platforms for seamless execution and analysis. Traders use these tools for different purposes.

TradingView.

However, both markets run differently in their charting, execution, and data feeds. While both markets support technical analysis, some traders find that high liquidity in forex leads to smoother chart patterns. Usually, the forex platforms are free, while futures platforms require paid and exchange-verified data.

Which Market Is Best for You as a Funded Trader?

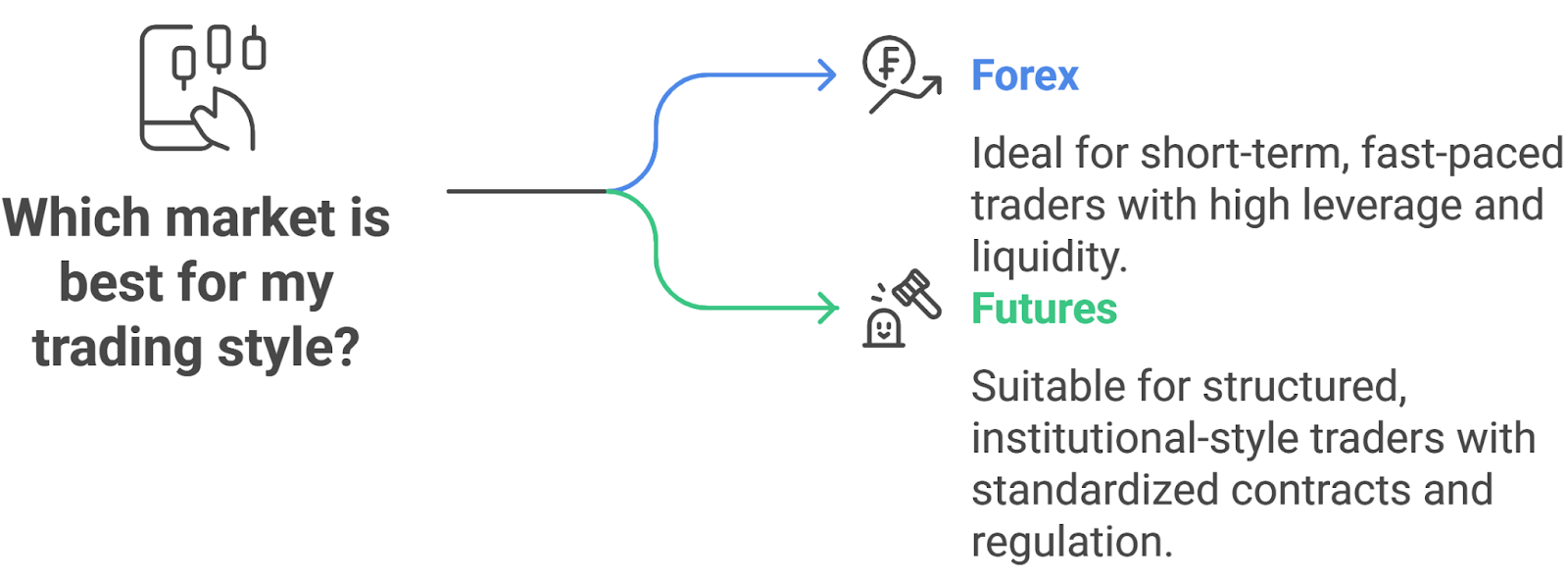

As a prop firm trader, your market choice should align with your trading style and risk appetite. Forex is an ideal choice for short-term and fast-paced traders who seek flexibility and fast execution. Futures work best for structured and institutional-style traders who seek regulated contracts and centralized regulation.

Conclusion

If you're deciding between forex and futures markets, you need to think about how much risk, liquidity, flexibility, and hours you are comfortable with. Futures deal in standardized contracts, operate through centralized exchanges, and offer more transparency and clarity. On the other hand, forex operates 24/7 all week and offers high liquidity and margin. FundingPips is the perfect choice for traders seeking access to financial resources for trading the forex market.

Ready to trade your fast-paced forex? Join FundingPips today to access substantial account size and advanced tools to trade toward success.